lemonade pet insurance

Estimated reading time: 12 minutes

Key Takeaways

- Lemonade covers accidents and illnesses for dogs and cats, including diagnostics and treatments.

- Optional add-ons offer extended coverage for vet visits, dental illness, behavioral care, and more.

- The reimbursement process is straightforward through the Lemonade app after paying your vet and meeting deductible and co-insurance.

- Pre-existing conditions and routine preventative care are excluded unless add-ons are purchased.

- Coverage limits, waiting periods, and pricing vary by location and plan choices, with real-time quotes provided in-app.

Table of contents

- Introduction

- What Lemonade pet insurance covers

- How the reimbursement process works

- Customization options and add-ons

- Policy structure, limits, and sample pricing

- Waiting periods and timing

- Exclusions you must note

- Chronic and repeat treatments

- Features that affect daily use

- What reviewers say

- How this policy works in practice

- Practical steps for your purchase decision

- Questions you should ask Lemonade or your agent

- Fast facts summary

- Final note for your next step

Introduction

You want protection for your dog or cat. You want a policy that pays when your pet gets sick or hurt. Lemonade pet insurance explains what it covers and how it works early in this post.

This piece reviews coverage, add-ons, limits, exclusions, and how you file claims. The facts below come from Lemonade and independent reviews. Each research point includes a source URL so you may link to it.

What Lemonade pet insurance covers

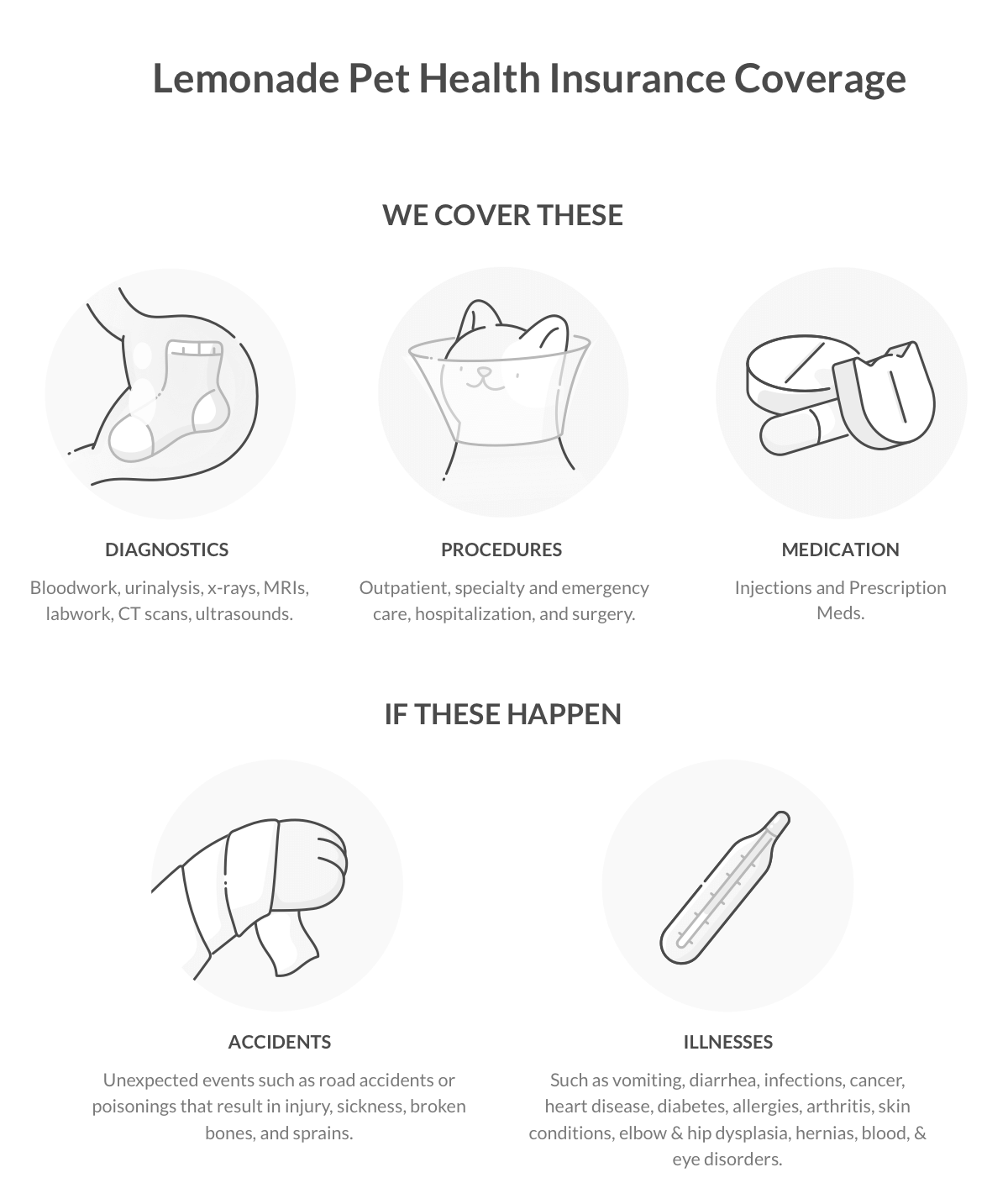

Lemonade offers reimbursement for eligible accidents and illnesses for dogs and cats. This includes diagnostics, procedures, medications, and treatments. The company lists these core coverages on its site and in reviews (lemonade.com/pet, pet insurance explained, independent review).

Key items in the base Accident and Illness policy

- Unexpected injuries and accidents are covered, including broken bones and trauma. (source)

- Cancer treatments such as chemotherapy and biopsies are included.

- Coverage for chronic diseases if not pre-existing.

- Hereditary and congenital conditions included, subject to pre-existing rules.

- Breed-specific issues and allergies covered when not pre-existing.

- Diagnostics such as X-rays, blood tests, and ultrasounds.

- Procedures including surgery and hospitalization.

- Prescription medications for covered conditions.

- Dental accidents are covered under the base policy.

- Dental illness and vet exam fees are available as add-ons with limits. (source)

How the reimbursement process works

You pay your vet bill at any licensed U.S. veterinarian. Then you submit a claim through the Lemonade app. Lemonade reimburses your bank after you meet the deductible and co-insurance applies. The company explains this process on its site (source, veterinary clinic info).

Customization options and add-ons

Lemonade lets you add optional coverage to match your needs. The app shows the base policy and add-on prices for your location. Add-ons vary by location. The details and limits appear on Lemonade pages and the add-ons explanation page.

Add-ons and their core features

- Vet Visit Fee: Covers exam fees for treatment. Optional. (source)

- Physical Therapy: Vet-administered therapies. Optional.

- Dental Illness: Illness-related dental care with monetary limits.

- Behavioral Conditions: Diagnostics and therapies by a vet or licensed behaviorist. Limits apply. Excludes training, CBD, and pre-existing behavioral issues.

- End-of-Life and Remembrance: Covers euthanasia, cremation, urns, paw prints, tattoos. Up to $500 limit; not subject to deductible or co-insurance.

- Preventative Packages: Covers wellness exams, vaccines, blood tests, heartworm tests, spay/neuter. Sold as separate packages; availability varies.

Policy structure, limits, and sample pricing

Lemonade lets you choose deductible, co-insurance, and annual payout limit. A sample setup shows a $500 deductible, 90% reimbursement, and a $20,000 annual limit with an annual premium around $274. This example appears in the video explanation.

Waiting periods and timing

Lemonade applies waiting periods to new policies. Coverage for incidents during the waiting period is not provided. Both the video and the site explain these rules.

Exclusions you must note

Lemonade excludes pre-existing conditions — e.g., allergies diagnosed before policy start. Routine preventive care (vaccinations, flea prevention, dental cleanings) is not covered unless purchased as an add-on. Experimental treatments are excluded. Details are on Lemonade’s policy pages and in independent reviews.

Chronic and repeat treatments

If a condition is eligible and not pre-existing, Lemonade will cover ongoing or repeat treatments until you reach your annual payout limit. This is important for chronic illnesses.

Features that affect daily use

- Coverage applies to both dogs and cats. Lemonade’s dog pages offer breed notes and savings examples.

- The app provides real-time quotes showing base coverage and add-ons for your location.

- You can use any licensed U.S. veterinarian; no network restrictions.

What reviewers say

Independent reviews describe the base policy as covering essentials and the add-ons as providing flexibility. They advise checking waiting periods and the definition of pre-existing conditions before buying. Coverage availability varies by location (review, video).

How this policy works in practice

Example 1, broken leg

- Your dog breaks a leg. Vet performs X-rays and surgery. You pay upfront, submit a claim via the Lemonade app. After deductible and co-insurance, Lemonade reimburses you. Diagnostics and surgery covered under base policy.

Example 2, chronic allergy

- Your cat develops an allergy after enrollment. If not pre-existing, ongoing diagnostics and medications are covered up to annual limit. If pre-existing, coverage is excluded.

Practical steps for your purchase decision

- List your pet’s medical history to identify pre-existing conditions, which are excluded.

- Compare deductibles and reimbursement levels; lower premiums can mean higher deductibles or lower reimbursement.

- Check waiting periods carefully to avoid gaps in coverage for new illnesses.

- Pick add-ons based on your pet’s needs, like dental care or behavioral therapy.

- Use any licensed vet — no network limits.

Questions you should ask Lemonade or your agent

- What is the waiting period for accidents and for illnesses? (video)

- Which items count as pre-existing under this policy? (independent review)

- What are the exact limits on dental illness and behavioral coverage? (add-ons page)

- Does availability differ for my state or zip code? (add-ons page)

Fast facts summary

- Base policy covers accidents and illnesses, including diagnostics, hospitalization, surgery, and prescriptions. (review, explanation)

- Dental accidents covered in base policy; dental illness requires add-on.

- File claims in app after you pay the vet. Reimbursement goes to your bank after deductible and co-insurance. (Lemonade site)

- Add-ons include vet visit fees, physical therapy, dental illness, behavioral care, end-of-life benefits, and preventive packages. Limits apply.

- No network restrictions; use any licensed U.S. vet.

- Pre-existing conditions and routine care excluded unless covered by add-ons.

Final note for your next step

Read the policy wording before buying. Use the Lemonade app to compare options and prices for your location. Check waiting periods and pre-existing condition rules carefully. For a quick sample quote, watch the video review showing $500 deductible, 90% reimbursement, and $20,000 annual limit with ~$274 yearly premium.

For full policy details and official updates, review the following sources: